Public Facility Corporations (PFCs) are increasingly important in Texas affordable housing. This guide explores PFCs, how they work, their pros and cons, and recent legislative updates.

Table Of Contents:

- Understanding Public Facility Corporations

- How Public Facility Corporations Work with Housing

- Benefits of Using Public Facility Corporations for Affordable Housing

- Drawbacks and Concerns Surrounding Public Facility Corporations

- 2023 Legislative Reforms and Their Impact on Public Facility Corporations

- Public Facility Corporation Example

- FAQs about Public Facility Corporations

- What is the difference between PFC and HFC in Texas?

- What is the PFC tax program in Texas?

- What is the PFC statute in Texas?

- Conclusion

Understanding Public Facility Corporations

A Public Facility Corporation is a non-profit created by local governments in Texas under Chapter 303 of the Texas Local Government Code . Cities, counties, or housing authorities establish them to finance and provide public facilities, including affordable housing.

These corporations issue bonds and partner with private developers. They operate with local government oversight to reduce project costs.

How Public Facility Corporations Work with Housing

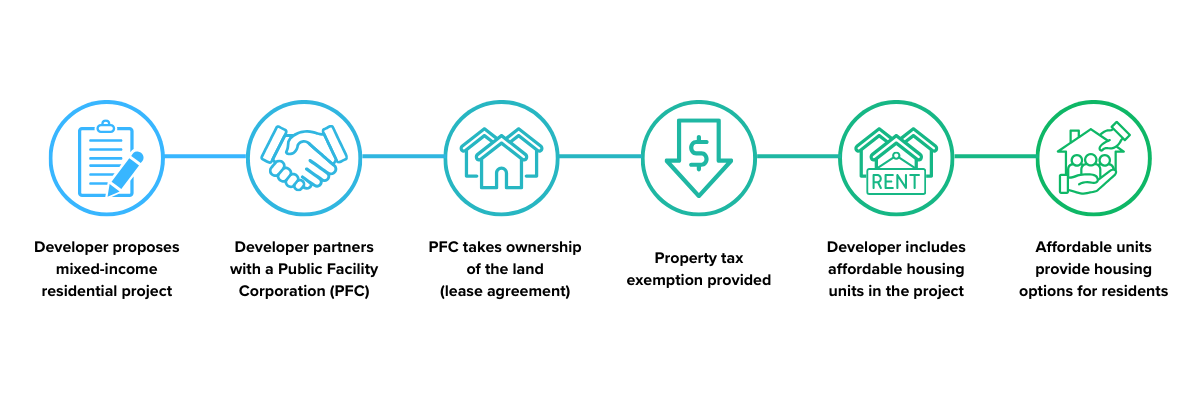

A private developer usually starts by proposing a mixed-income residential project. Once the project is approved and financing is secured, the developer partners with a Public Facility Corporation (PFC).

The PFC typically takes ownership of the land through a lease agreement and then leases it back to the developer. In return, the property gets a tax exemption, as long as the developer includes affordable housing units in the project. These income-restricted units give residents more housing options at lower costs.

Benefits of Using Public Facility Corporations for Affordable Housing

Public Facility Corporations (PFCs) make it easier to build affordable multifamily housing. By providing property tax exemptions, they help lower project costs so developers can offer lower rents for income-restricted units. It’s a win-win for developers and renters alike!

PFCs also create public-private partnerships that bring together resources and expertise. These partnerships don’t just build housing—they help revitalize neighborhoods, grow communities, and even boost local property values. By keeping housing affordable for those who serve the community, everyone benefits.

PFCs provide financial assistance for moderate-income households earning at or below the area median income. This is especially valuable for essential workers like teachers and firefighters. By keeping housing affordable for those who serve the community, PFCs enhance local economies and make it easier for communities to thrive. Affordable housing options also help cities meet fair housing guidelines and ensure compliance with important regulations.

Drawbacks and Concerns Surrounding Public Facility Corporations

One concern is the potential loss of sales tax revenue for schools and other local government entities. School districts are often exempt from paying rent for space owned by a PFC but still rely on that property being added to the tax rolls for revenue. This creates a tricky balancing act between funding education and encouraging affordable housing.

Rising market rents raise questions about affordability for those households making at or below the area median income. Some worry PFC projects primarily benefit moderate-income families who wouldn’t qualify for housing choice voucher programs. It’s a valid concern: Are we helping the people who need it most?

Recent laws increase accountability for development choices receiving tax breaks. These changes ensure fair distribution of public facility corporation support and consideration for how PFC deals could impact the tax code and other governmental compliance considerations like rent restrictions for the sake of residents and communities overall. Stronger accountability helps keep everyone on the same page—and ensures these projects fulfill their promises.

- For more information about these changes, see Texas House Bill 2071.

- You can read about Texas House Bill 2679.

2023 Legislative Reforms and Their Impact on Public Facility Corporations

The 2023 Texas legislative session significantly changed PFC regulations through legislation promoting transparency and accountability. This includes stricter requirements for income restrictions, median income levels for qualification and reporting guidelines, along with compliance monitoring standards. These updates aim to ensure PFCs truly serve the communities they’re meant to help—no loopholes, no exceptions.

Public Facility Corporation Example

The City of Denton explored using a Public Facility Corporation to address rising rental costs. They conducted a survey to understand resident perspectives. By listening to the people who live there, local leaders could make smarter, more impactful decisions. Hopefully, we’ll see the positive effects of their efforts in the coming years!

FAQs about Public Facility Corporations

What is the difference between PFC and HFC in Texas?

Both Public Facility Corporations (PFCs) and Housing Finance Corporations (HFCs) facilitate housing development in Texas. PFCs are created by local governments. HFCs are separate non-profit organizations.

A key distinction is the ability of PFCs to offer property tax exemptions, which incentivizes developers. Both PFCs and HFCs can help with housing finance, specifically targeting those households making at or below area median income. However, not all units provided may meet the strict requirements of low-income-restricted housing regulations, which is an important distinction for those navigating these programs.

What is the PFC tax program in Texas?

The PFC “tax program” refers to property tax exemptions offered through a local government code to developers partnered with PFCs on mixed-income housing projects.

If a portion of the housing units are designated “affordable,” the property may be partially or fully exempt from property taxes. This exemption depends on reporting requirements, compliance monitoring, the size of the family seeking residency, area median income considerations and other applicable laws. In some cases, these exemptions tie into housing tax credits, requiring developers to meet additional financial assistance stipulations and provide documentation, such as pay stubs and bank statements.

What is the PFC statute in Texas?

The PFC statute is Chapter 303 of the Texas Local Government Code, which governs Public Facility Corporations.

Recent housing tax credits along with Texas House Bills 2679 and 2071 impact reporting, oversight, and regulations. Reviewing these bills is crucial for those working with PFCs, as Texas House Bill 2071 significantly increases transparency around multifamily residential developments and other housing projects undertaken using affordable housing financial assistance funds.

These reforms address loopholes to ensure PFCs achieve their intended purpose —maximizing affordable housing units while balancing public and private interests. Ultimately increasing overall financial benefits available in housing choice voucher programs for the most in-need. As real property is being used as a leverage tool here between private and public interests there can also be a significant boost to financial and general overall economic activity for a given community as more moderate-income housing and residential units can allow those who might not otherwise be able to remain living within those areas an increased number of real housing and other living arrangement options. Especially considering rising rents in more popular areas or desirable areas as times change. While also considering how area median incomes also change over time and also may fluctuate depending on which community the PFC deal has happened. Which all has a compounding effect on financial and other overall economic conditions of a given locale that are always changing and unique due to their dynamic nature and dependence on ever shifting external and sometimes unforeseen factors impacting a local and wider economy.

Conclusion

Public Facility Corporations offer a valuable tool for addressing affordable housing needs. However, they require careful consideration and adherence to local and federal governmental oversight guidelines. Navigating these complexities is crucial to maximizing the benefits PFCs can provide.

The 2023 Texas legislative reforms, including House Bills 2071 and 2679, enhance transparency and accountability to ensure PFC activities truly benefit the public. These bills focus on income restrictions, market rents, appraisal district valuation standards, and housing choice voucher program acceptance. By addressing these areas, the reforms provide clarity for public facility users, housing providers, and the broader public, empowering all stakeholders to make informed decisions about affordable housing options.

Balancing economic development with true affordability is vital, and future evaluations of Public Facility Corporations’ long-term impact will be essential. Ultimately, PFCs should contribute positively toward housing finance goals set out by local governments and housing authorities. However, managing compliance with these regulations can be a challenge for affordable housing agencies, and that’s where Sanchez Compliance and Consulting can help.

At Sanchez Compliance and Consulting, we specialize in minimizing affordable housing agencies’ exposure to non-compliance. Our customized compliance solutions include:

- General consulting (virtual and on-site)

- In-depth file reviews to ensure all residents meet qualification standards

- LURA/Regulatory Agreement reviews to ensure program requirements are met

- Preparation of HUD Model Schedules in Texas

- NEW Service: 3rd Party PFC Audit Services

We understand the urgency of reviewing files quickly to meet occupancy and compliance goals. Say goodbye to missed deadlines and hello to streamlined compliance. Reach out to Sanchez Compliance and Consulting today, and let us take the guesswork out of your compliance needs.